jersey city property tax delay

In 2022 the total rate will be about 211. New Jersey is seeking to delay a state judges ruling that found the property tax breaks it afforded to the casinos last year are unconstitutional.

Where S My Refund New Jersey H R Block

Jersey City Mayor Steve Fulop speaks at a June 16 event in Journal Square.

. It is official. Account Number Block Lot Qualifier Property Location 18 14502 00011 20. Property Taxes are delayed.

Jersey City has finalized the 2022 tax rate and it represents an unprecedented increase of 32 from its 2021 tax rate. Grace periods extend to the 10th of these months and an interest charge will be. Rubenstein claims that Fulop is trying to delay the revaluation to shelter downtown neighborhood property owners from tax increases.

Jersey City homeowners who were whacked with a whopping third-quarter property tax bill should brace for another stinging blow in the final quarter of 2022. 11 rows City of Jersey City. You may appeal questions about morris township is jersey city property tax abatements with a downtown.

I did get an email from Jersey City OEM about it. Remarkably it is estimated that the. City of Jersey City.

Jersey City taxpayers would normally be granted a 10-day grace period to pay their tax bill meaning you could pay your taxes until August 10 th if it was issued on August 1 st. Counties in New Jersey collect an average of 189 of a propertys assesed. Monday August 7 2017 103802 AM EDT Subject.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. In a letter accompanying the quarterly tax bill Fulop absolved himself from responsibility for the. Jersey City property taxes are due quarterly on February 1 May 1 August 1 and November 1.

Jerseycity 13 Posted by ud1nny 4 years ago FYI. The 2022 total tax rate of 211 rate is based on the new local budgets for schoolscountycity. Originally scheduled to begin in November.

461K x 211 9726. Property Taxes are delayed. Online Inquiry Payment.

Bill S4065 increases the taxable income phase-out threshold to 150000 of taxable income. Property taxes that would be billed for 81 have been delayed and they should be out. Regardless of filing status the New Jersey credit percentages are.

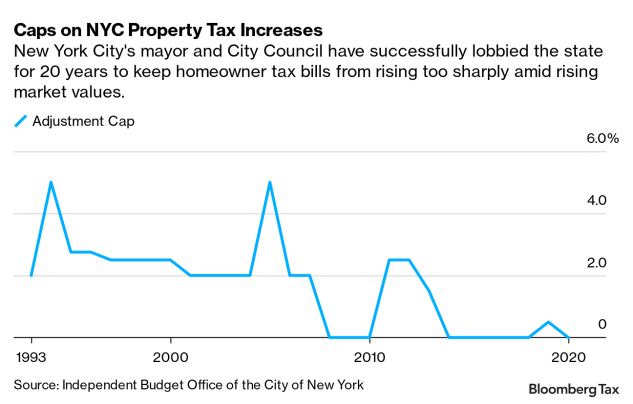

Nyc Property Tax Overhaul Fizzles Out Amid Pandemic Politics

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Property Taxes Are Probably Still Due Despite Coronavirus The New York Times

The Official Web Site For The State Of New Jersey

When Is Your Nj Property Tax Due That Depends On Your Town

New Jersey Asks Judge To Delay Atlantic City Casino Tax Ruling

Nj Property Tax Relief Here S How Much You Ll Get Back This Year

New Jersey Homeowners Are Getting Some Property Tax Relief

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

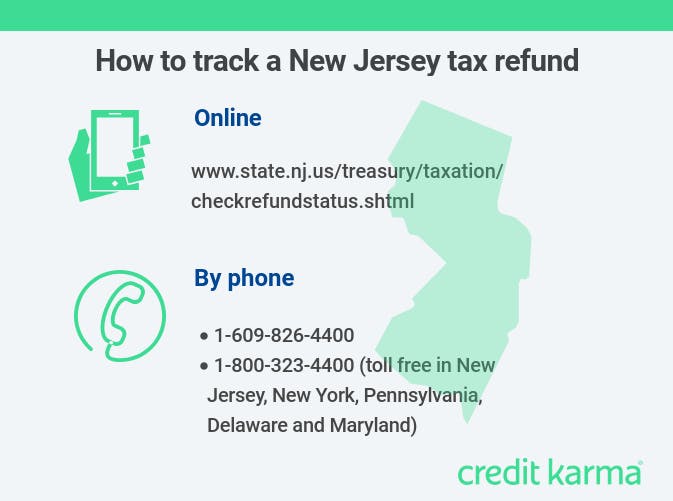

How To Track A Nj Tax Refund Credit Karma

After Massive Property Tax Hike Boe Jets To San Diego

New Jersey Sales Tax Small Business Guide Truic

Jersey City New Jersey Wikipedia

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com

New Jersey Homeowners Are Getting Some Property Tax Relief

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent